The Feie Calculator PDFs

Wiki Article

Things about Feie Calculator

Table of ContentsThe smart Trick of Feie Calculator That Nobody is DiscussingGetting The Feie Calculator To WorkNot known Incorrect Statements About Feie Calculator Feie Calculator Things To Know Before You Buy8 Simple Techniques For Feie CalculatorWhat Does Feie Calculator Do?The 8-Second Trick For Feie Calculator

If he 'd frequently traveled, he would rather finish Component III, listing the 12-month period he met the Physical Presence Test and his traveling history. Action 3: Coverage Foreign Earnings (Part IV): Mark gained 4,500 per month (54,000 yearly).Mark determines the exchange price (e.g., 1 EUR = 1.10 USD) and converts his income (54,000 1.10 = $59,400). Because he stayed in Germany all year, the percentage of time he resided abroad during the tax obligation is 100% and he gets in $59,400 as his FEIE. Lastly, Mark reports complete earnings on his Form 1040 and goes into the FEIE as a negative quantity on Set up 1, Line 8d, reducing his gross income.

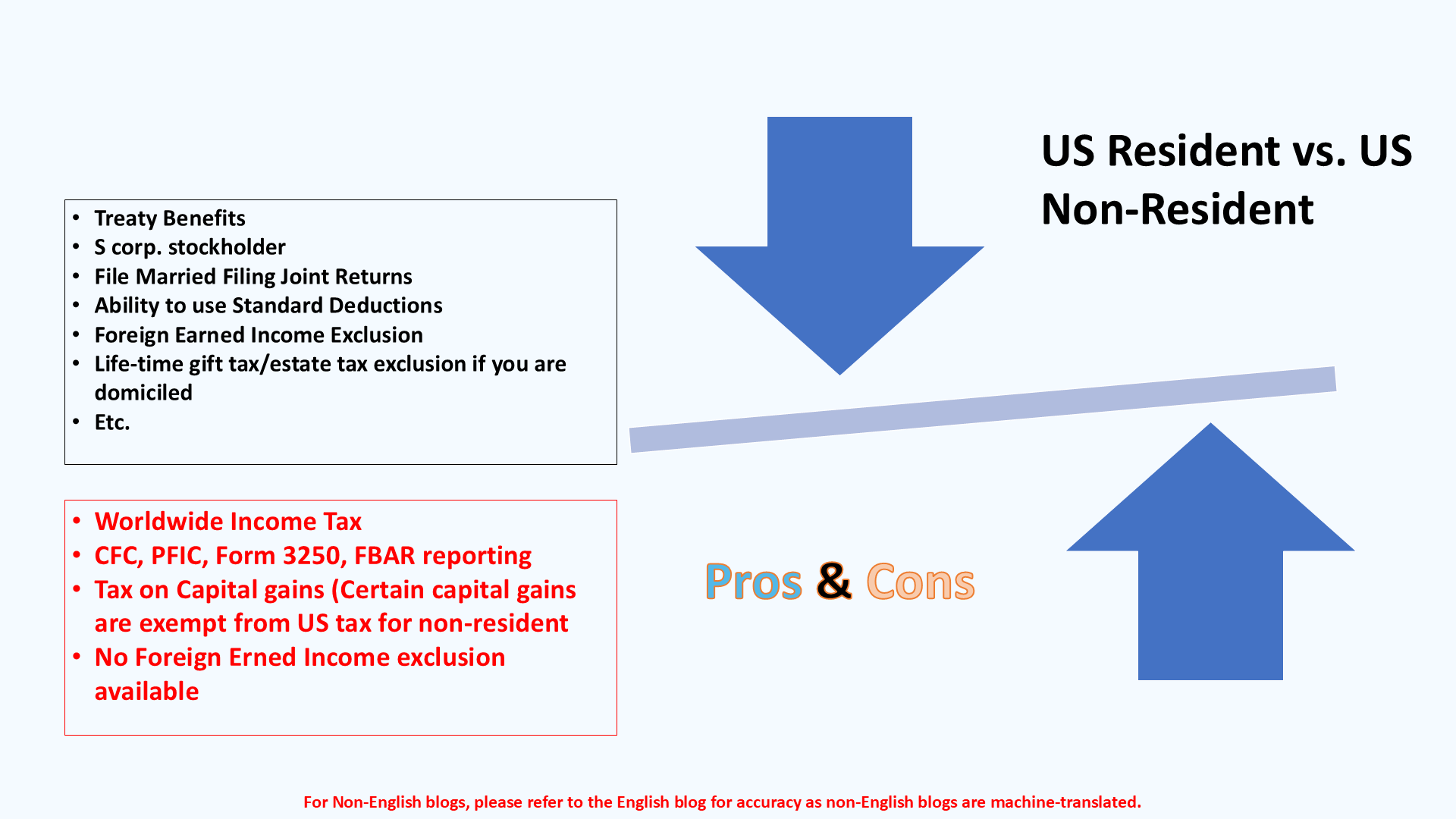

Picking the FEIE when it's not the very best option: The FEIE may not be optimal if you have a high unearned income, make greater than the exclusion limit, or stay in a high-tax nation where the Foreign Tax Credit Report (FTC) might be more useful. The Foreign Tax Obligation Credit Report (FTC) is a tax decrease strategy often used together with the FEIE.

Things about Feie Calculator

expats to offset their united state tax financial obligation with international revenue tax obligations paid on a dollar-for-dollar decrease basis. This indicates that in high-tax nations, the FTC can often get rid of U.S. tax financial debt totally. The FTC has constraints on eligible tax obligations and the optimum case quantity: Eligible tax obligations: Only earnings tax obligations (or taxes in lieu of income tax obligations) paid to international governments are qualified (FEIE calculator).tax obligation obligation on your foreign revenue. If the international tax obligations you paid exceed this limitation, the excess foreign tax obligation can typically be carried ahead for as much as ten years or brought back one year (through a changed return). Keeping exact records of international earnings and tax obligations paid is as a result important to computing the appropriate FTC and keeping tax conformity.

expatriates to reduce their tax obligation responsibilities. For circumstances, if an U.S. taxpayer has $250,000 in foreign-earned income, they can omit as much as $130,000 making use of the FEIE (2025 ). The continuing to be $120,000 may after that go through taxes, however the U.S. taxpayer can potentially use the Foreign Tax Credit to offset the taxes paid to the foreign nation.

What Does Feie Calculator Mean?

He marketed his U.S. home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his better half to aid accomplish the Bona Fide Residency Test. Neil points out that purchasing home abroad can be testing without initial experiencing the place."We'll absolutely be beyond that. Also if we come back to the US for medical professional's consultations or company calls, I question we'll spend more than 30 days in the United States in any kind of given 12-month duration." Neil highlights the value of strict monitoring of U.S. gos to. "It's something that individuals need to be truly persistent regarding," he states, and suggests expats to be cautious of usual errors, such as overstaying in the united state

Neil is mindful to anxiety to united state tax authorities that "I'm not performing any kind of service in Illinois. It's simply a mailing address." Lewis Chessis is a tax expert on the Harness platform with extensive experience aiding united state residents navigate the often-confusing world of worldwide tax obligation compliance. One of one of the most typical mistaken beliefs among U.S.

Not known Details About Feie Calculator

income tax return. "The Foreign Tax Credit score allows individuals operating in high-tax nations like the UK to offset their U.S. tax obligation by the amount they've already paid in tax obligations abroad," states Lewis. This makes certain that expats are not tired twice on the very same income. Nonetheless, those in reduced- or no-tax nations, such as the UAE or Singapore, face added hurdles.

The possibility of lower living prices can be alluring, yet it commonly comes with compromises that aren't right away evident - https://justpaste.it/2891m. Housing, as an example, can be a lot more inexpensive in some nations, however this can imply jeopardizing on infrastructure, safety and security, or accessibility to dependable energies and services. Inexpensive residential or commercial properties may be located in locations with inconsistent web, limited public transport, or unstable medical care facilitiesfactors that can substantially affect your daily life

Below are a few of one of the most regularly asked questions regarding the FEIE and various other exclusions The International Earned Revenue Exclusion (FEIE) permits U.S. taxpayers to omit as much as $130,000 of foreign-earned earnings from government earnings tax obligation, lowering their U.S. tax obligation. To certify for FEIE, you need to satisfy either the Physical Existence Test (330 days abroad) or the Authentic House Test (prove your main residence in an international nation for an entire tax year).

The Physical Visibility Test likewise needs U.S. taxpayers to have both an international revenue and a foreign tax home.

The Greatest Guide To Feie Calculator

An earnings tax obligation treaty in between the U.S. and an additional country can assist protect against dual taxes. While the Foreign Earned Revenue Exemption lowers gross income, a treaty might provide extra benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a needed declare U.S. people with he has a good point over $10,000 in foreign financial accounts.

The international gained earnings exclusions, often described as the Sec. 911 exemptions, omit tax on earnings earned from working abroad. The exclusions consist of 2 components - a revenue exclusion and a housing exemption. The complying with Frequently asked questions discuss the benefit of the exemptions including when both partners are deportees in a general manner.

4 Easy Facts About Feie Calculator Explained

The tax benefit leaves out the earnings from tax obligation at lower tax prices. Previously, the exemptions "came off the top" reducing revenue subject to tax at the top tax rates.These exemptions do not spare the incomes from US taxation but just supply a tax obligation reduction. Note that a bachelor working abroad for all of 2025 that earned regarding $145,000 without any other income will certainly have gross income lowered to zero - efficiently the very same answer as being "free of tax." The exclusions are calculated on a day-to-day basis.

If you participated in service conferences or workshops in the US while living abroad, income for those days can not be omitted. Your incomes can be paid in the United States or abroad. Your company's area or the location where salaries are paid are not consider receiving the exclusions. Taxes for American Expats. No. For United States tax obligation it does not matter where you maintain your funds - you are taxed on your worldwide earnings as a United States person.

Report this wiki page